Effects of State Cost-Sharing Reduction Pricing Guidelines on ACA Plan Premiums

By Lydia Tolman

Health Watch, May 2025

Cost sharing reduction (CSR) payments are offered to low-income individual insurance buyers under the Patient Protection and Affordable Care Act (ACA). Such payments are provided through silver plan variants (73%, 87% and 94% actuarial values) with reduced cost-sharing requirements relative to the standard silver plans (70% actuarial value). These variants are part of the standard plan and are customer-facing. Prior to October 2017, the difference in costs to insurers between the standard silver plan (70%) and the silver plan variants (73%, 87% or 94%) were reimbursed by the federal government. After the reimbursements were defunded, insurers had to increase premiums to offset the CSR costs not being reimbursed in the silver plan variants. These adjustments are often referred to as “CSR loading.”

Since CSR loading increases premium costs on silver plans that determine subsidies, they also increase federal payments for premium tax credit (PTC) subsidies. Guidance from the US Department of Health and Human Services (HHS) on silver plan pricing has evolved over time.[1]

There are three types of CSR loading:

- Broad loading: Increase premiums for all metal level variants in the individual exchange market.

- Silver loading

- On/off exchange: Increase premiums for all silver plans.

- On-exchange: Increase premiums for only on-exchange silver plans. This has the highest impact on PTC subsidies.

Increased PTC subsidies can lead to relatively cheaper bronze and gold plans for subsidized members since subsidies are determined based on the second lowest cost silver plan in the market.

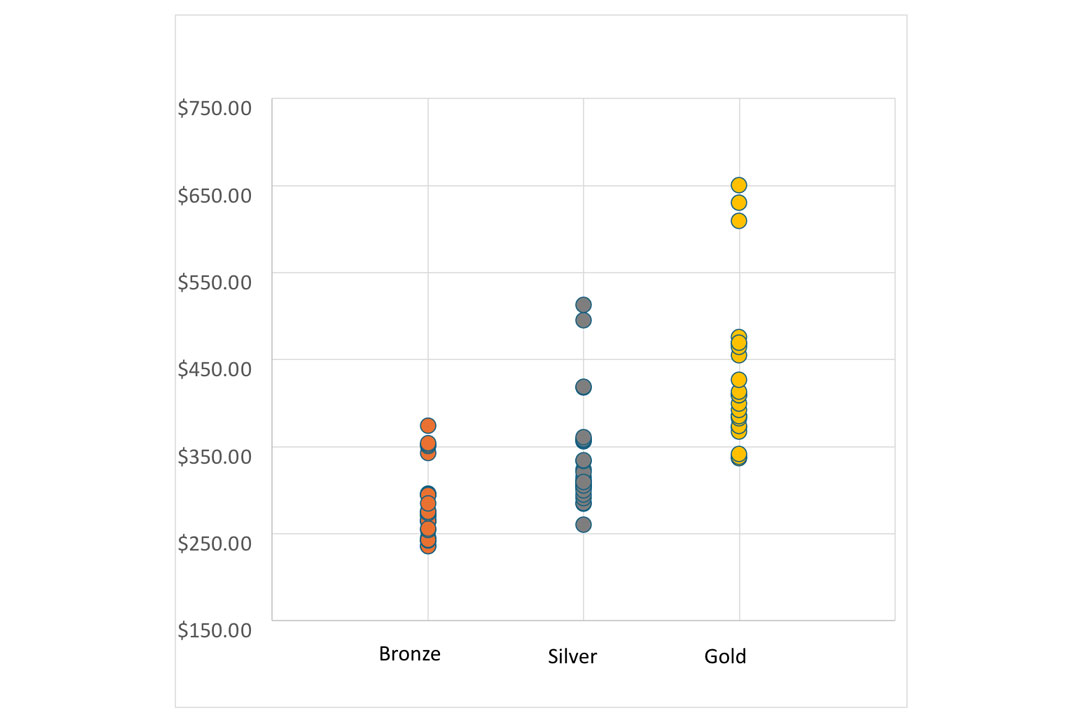

Some interesting differences are emerging between states, as they approach silver loading differently. For example, New Mexico has mandated a 44% silver CSR load, which assumes only the richest silver plan variants will be purchased and results in premiums that more closely match true plan costs. This generally results in the PTC subsidies being funded to the greatest degree by the federal government and makes gold plans cheaper than silver plans, which is not the pattern seen in other states that don’t mandate silver CSR load levels. In 2024, silver plans were typically 20% more expensive than gold plans (with some outliers), and only one in five carriers offered a bronze plan, as seen in Figure 1.

Figure 1

Premium by Metal Level for a 21-Year-Old in Albuquerque, New Mexico

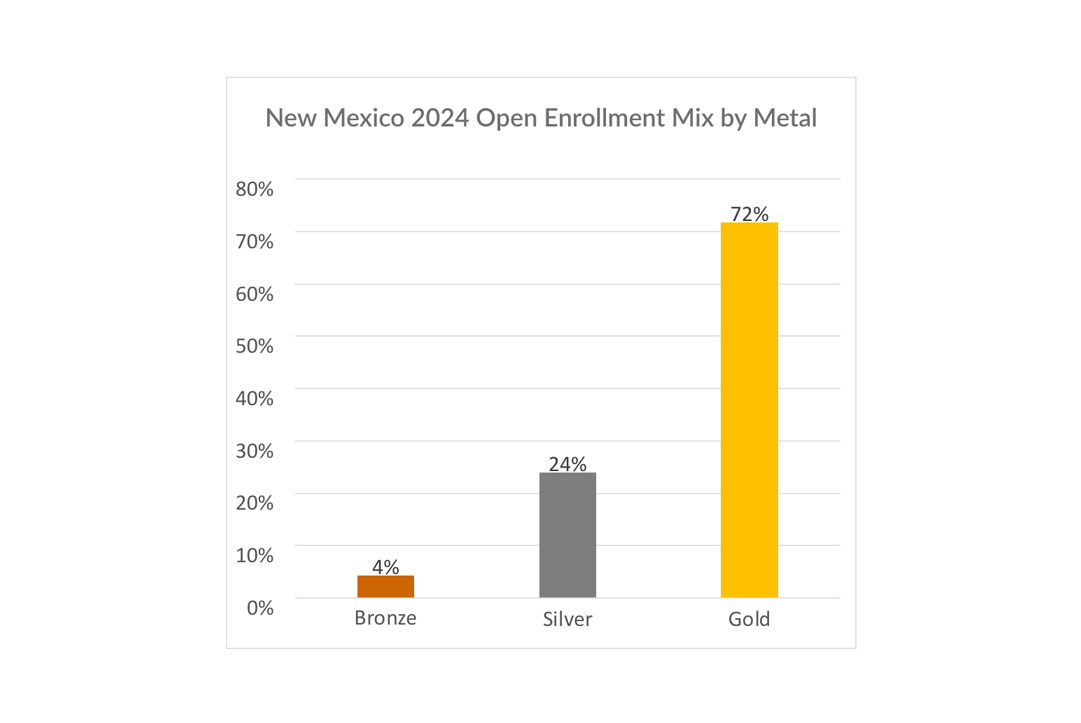

As a result, the 2024 mix of enrollment by metal for New Mexico looks quite different compared to the national mix, as seen in Figure 2.

Figure 2

National 2024 Open Enrollment Mix by Metal Compared to That of New Mexico

|

|

|---|---|

|

Excluding Catastrophic and Platinum level membership (Platinum is only 1% nationally.) |

Conversely, Arizona, which is located right next to New Mexico, does not have a mandated silver load, and premiums look more like what one would expect based on the standard plan differences in actuarial value. In 2024, silver plans are 15%–25% cheaper than gold plans and 10%–25% more expensive than bronze plans. The difference is illustrated in Figure 3.

Figure 3

Premium by Metal Level for a 21-Year-Old in Maricopa County, Arizona

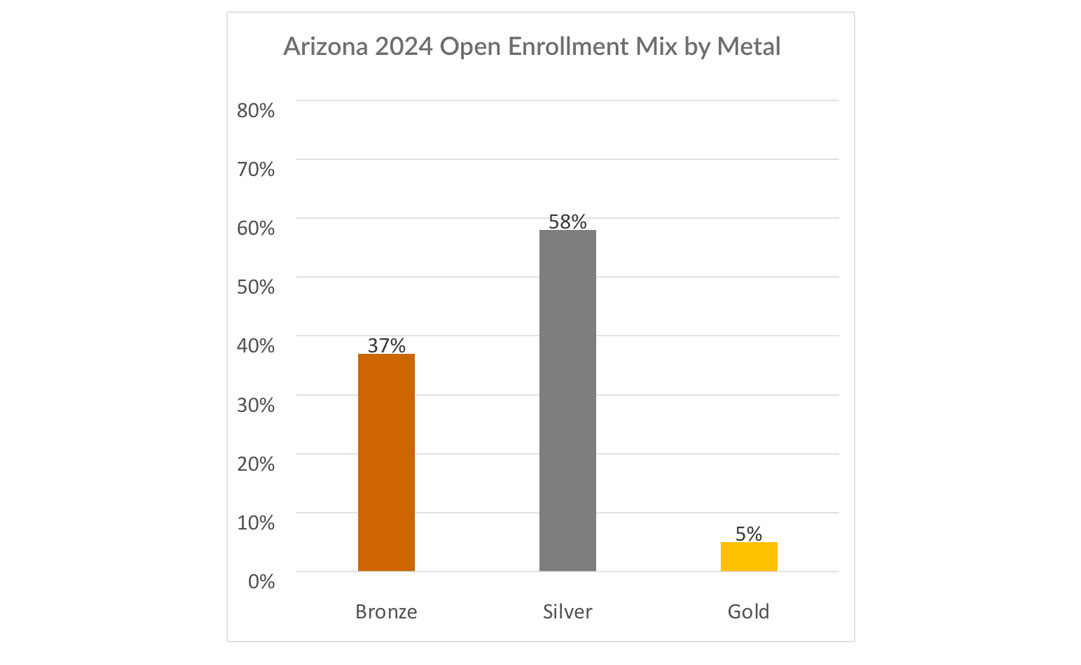

As a result, the enrollment mix by metal in Arizona looks much more like the national average, as shown in Figure 4.

Figure 4

National 2024 Open Enrollment Mix by Metal Compared to That of Arizona

|

|

|---|---|

|

Excluding Catastrophic and Platinum level membership (Platinum is only 1% nationally.) |

What does this mean for consumers in New Mexico and Arizona? For the unsubsidized, there is not a substantive difference in costs between the two states. The cheapest plan for a 40-year-old making $100,000 per year (686% of the federal poverty level [FPL]) is $314 per month in New Mexico and $300 per month in Arizona. For the subsidized, however, there is a big difference between the two states. The cheapest plan for a 40-year-old making $45,000 per year (309% FPL) is only $100 per month in New Mexico and $169 per month in Arizona. Additionally, the cheapest plan in New Mexico is a gold plan as compared to Arizona, where the cheapest plan is a bronze-level plan. So, New Mexicans are getting a richer benefit plan for lower costs than a similar person right next door in Arizona.

Of course, this money has to come from somewhere. New Mexico’s substantially higher silver plan rates, which drive the PTC subsidies, mean that the federal government is paying out more money for someone in New Mexico than for someone in Arizona, ceteris paribus. Additionally, the federal government is paying out more money by defunding CSR subsidies than it would if it reverted to the rules that were in place when the ACA was initially implemented because of higher PTC subsidy costs. The question going forward is whether other states will make similar mandates to New Mexico and how the Centers for Medicare & Medicaid Services, Center for Consumer Information and Insurance Oversight and HHS will react to increasing costs through higher PTC subsidy costs.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Lydia Tolman, FSA, MAAA, is a senior consulting actuary II at Wakely. Lydia can be reached at lydia.tolman@wakely.com.

Endnote

[1] Department of Health and Human Services, “Potential Fiscal Consequences of Not Providing CSR Reimbursements,” ASPE Issue Brief, December 2015, https://aspe.hhs.gov/sites/default/files/migrated_legacy_files/130481/ASPE_IB_CSRs.pdf; Samara Lorenz, “Insurance Standards Bulletin Series—Information,” Centers for Medicare & Medicaid Services, August 3, 2018, https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/Offering-plans-not-QHPs-without-CSR-loading.pdf; “Code of Regulations: 45 CFR § 156.80,” National Archives, last amended March 25, 2025, https://www.ecfr.gov/current/title-45/subtitle-A/subchapter-B/part-156/subpart-A/section-156.80.